Summarize this article:

107 Learners

107 LearnersLast updated on September 26, 2025

Math Formula for Monthly Compound Interest

In finance, understanding how compound interest works is crucial for managing loans, investments, and savings. The monthly compound interest formula helps determine how much interest will be earned or paid on an investment or loan when interest is compounded monthly. In this topic, we will learn the formula for calculating monthly compound interest.

List of Math Formulas for Monthly Compound Interest

The formula to calculate monthly compound interest is essential for financial planning. Let’s learn the formula to calculate monthly compound interest and understand how it’s applied in different scenarios.

Math Formula for Monthly Compound Interest

The Monthly Compound Interest formula calculates the future value of an investment or loan based on interest that is compounded monthly.

It is expressed as: [ A = P \left(1 + \frac{r}{n}\right){nt} ]

Where: ( A ) is the amount of money accumulated after n years, including interest.

( P ) is the principal amount (the initial amount of money).

( r ) is the annual interest rate (decimal).

( n ) is the number of times that interest is compounded per year (12 for monthly).

( t ) is the time the money is invested or borrowed for, in years.

Importance of the Monthly Compound Interest Formula

In finance and investing, the monthly compound interest formula is critical for calculating the growth of investments and the cost of loans over time.

Here are some important points about using the monthly compound interest formula:

- It helps investors understand the potential growth of their investments.

- It allows borrowers to see how much they will owe over the life of a loan.

- It provides insight into the effects of interest rates and compounding frequency on financial decisions.

Tips and Tricks to Memorize the Monthly Compound Interest Formula

Many find financial formulas challenging, but with practice, you can master them.

Here are some tips and tricks to help memorize the monthly compound interest formula:

- Break down the formula into parts: remember P for principal, r for rate, n for compounding frequency, and t for time.

- Practice with real-life examples, such as calculating interest on a savings account or mortgage.

- Use flashcards to memorize the components of the formula and rewrite them for quick recall.

- Create scenarios in which you apply the formula to reinforce understanding.

Real-Life Applications of the Monthly Compound Interest Formula

In real life, we use the monthly compound interest formula to manage personal finances and investments.

Here are some applications of the formula:

- In savings accounts, to calculate how much interest will be earned over time.

- In loans, to determine the total amount owed over the life of the loan.

- In investments, to project future growth based on historical interest rates.

Common Mistakes and How to Avoid Them While Using the Monthly Compound Interest Formula

Errors in calculating monthly compound interest can lead to inaccurate financial planning. Here are some common mistakes and ways to avoid them:

Examples of Problems Using the Monthly Compound Interest Formula

Problem 1

Calculate the amount accumulated after 3 years for a principal of $1,000 at an annual interest rate of 5% compounded monthly.

The amount accumulated is $1,161.62

Explanation

Using the formula: [ A = 1000 left(1 + frac{0.05}{12}right){12 times 3} ]

[ A = 1000 left(1 + 0.0041667right){36} ]

[ A = 1000 \times (1.0041667){36} ]

[ A = 1000 \times 1.16162 ]

[ A = 1161.62 ]

Problem 2

Find the future value of a $500 investment after 2 years at an annual interest rate of 6% compounded monthly.

The future value is $563.71

Explanation

Using the formula: [ A = 500 left(1 + \frac{0.06}{12}right){12 times 2} ]

[ A = 500 left(1 + 0.005\right){24} ]

[ A = 500 times (1.005){24} ]

[ A = 500 times 1.12716 ]

[ A = 563.71 ]

Problem 3

Determine the total amount after 5 years for a $2,000 principal at an annual rate of 4% compounded monthly.

The total amount is $2,432.86

Explanation

Using the formula: [ A = 2000 \left(1 + frac{0.04}{12}\right){12 times 5} ]

[ A = 2000 \left(1 + 0.0033333\right){60} ]

[ A = 2000 \times (1.0033333){60} ]

[ A = 2000 \times 1.21643 ]

[ A = 2432.86 \]

Problem 4

A loan of $1,500 is taken, and the interest is compounded monthly at a 3% annual rate. How much will be owed after 4 years?

The amount owed is $1,690.49

Explanation

Using the formula: [ A = 1500 left(1 + frac{0.03}{12}\right){12 \times 4} ]

[ A = 1500 \left(1 + 0.0025\right){48} ]

[ A = 1500 \times (1.0025){48} ]

[ A = 1500 times 1.12699 ]

[ A = 1690.49 \]

Problem 5

What is the final amount of a $3,000 deposit after 6 years with an annual interest rate of 2.5% compounded monthly?

The final amount is $3,494.88

Explanation

Using the formula: [ A = 3000 \left(1 + \frac{0.025}{12}\right){12 \times 6} ]

[ A = 3000 \left(1 + 0.0020833\right){72} ]

[ A = 3000 \times (1.0020833){72}]

[ A = 3000 \times 1.16496 ]

[ A = 3494.88 ]

FAQs on Monthly Compound Interest Formula

1.What is the monthly compound interest formula?

2.How does monthly compounding affect investments?

3.What are the benefits of using the monthly compound interest formula?

4.How does the compounding frequency impact the final amount?

5.What is the principal in the compound interest formula?

Glossary for Monthly Compound Interest Formula

- Principal: The initial amount of money invested or borrowed.

- Interest Rate: The percentage at which interest is earned or paid.

- Compound Interest: Interest calculated on the initial principal and also on the accumulated interest from previous periods.

- Compounding Frequency: The number of times interest is compounded per year.

- Future Value: The amount of money accumulated after interest is applied over a certain period.

Explore More math-formulas

![Important Math Links Icon]() Previous to Math Formula for Monthly Compound Interest

Previous to Math Formula for Monthly Compound Interest

![Important Math Links Icon]() Next to Math Formula for Monthly Compound Interest

Next to Math Formula for Monthly Compound Interest

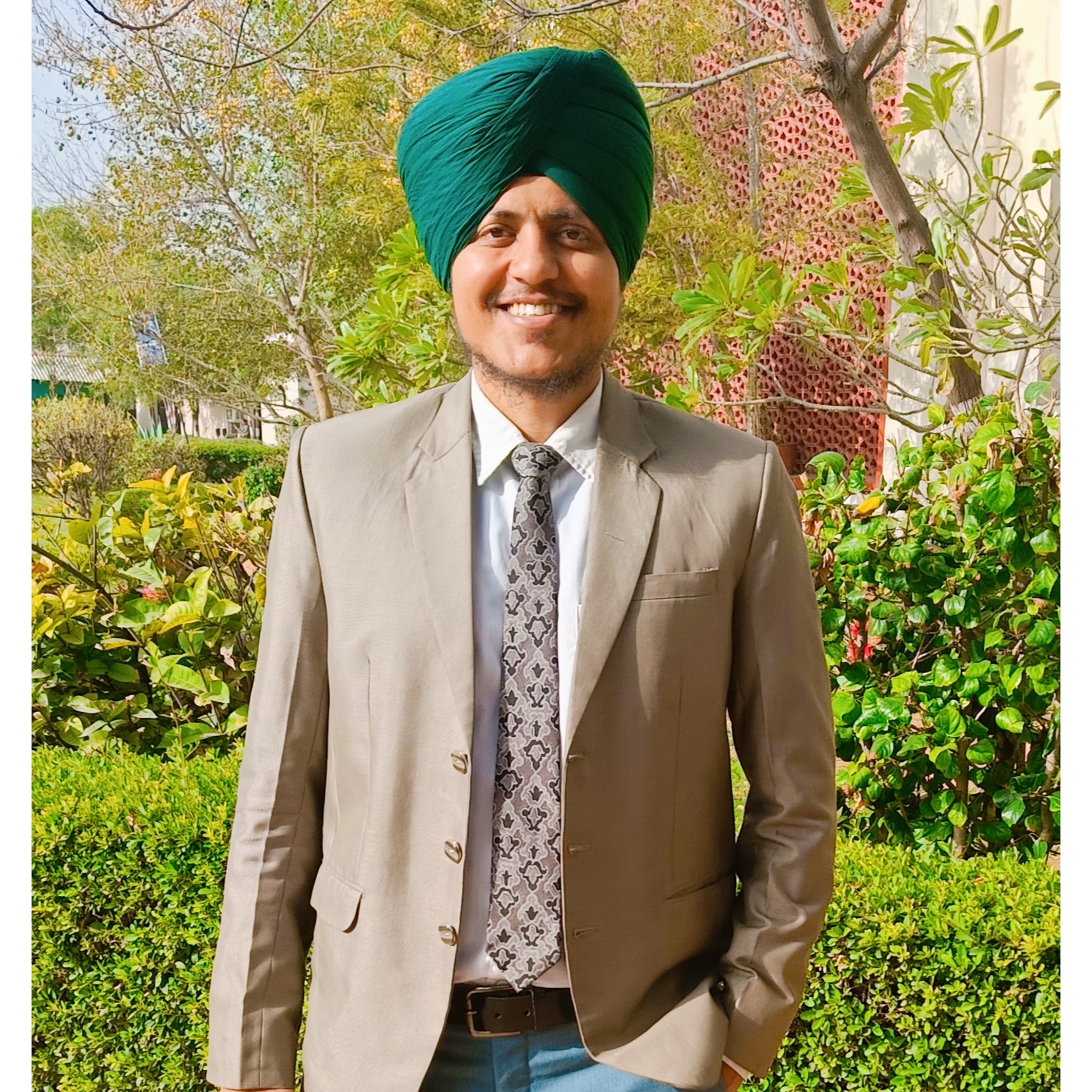

Jaskaran Singh Saluja

About the Author

Jaskaran Singh Saluja is a math wizard with nearly three years of experience as a math teacher. His expertise is in algebra, so he can make algebra classes interesting by turning tricky equations into simple puzzles.

Fun Fact

: He loves to play the quiz with kids through algebra to make kids love it.