In the hustle and bustle of today’s fast-paced world, navigating the financial landscape has become increasingly complex. It’s no secret that money matters plays a pivotal role in shaping our lives, influencing everything from education and career growth choices to our overall well-being. In this era of economic intricacies, the relevance of introduction to financial literacy has never been more crucial. Join us as we delve into the essential aspects of understanding and mastering the language of finance, starting with the fundamental importance of financial literacy in our daily lives.

Table of contents

- Why is Financial Literacy Important?

- The Economic Impact

- The Educational Aspect

- Personal Finance and Decision-Making

- Entrepreneurship and Business

- Financial Literacy and Technology

- Overcoming Barriers to Financial Literacy

- Financial Literacy and Sustainable Living

- The Future of Financial Literacy

- Conclusion

- Frequently Asked Questions

Why is Financial Literacy Important?

Empowering Individuals

Financial literacy is the key to unlocking the door of empowerment. It’s not just about balancing budgets; it’s about understanding the power dynamics of money. When individuals comprehend the nuances of finances, they gain the confidence to make informed decisions, shaping their destinies with purpose.

Navigating Life Transitions

Life is a journey peppered with transitions—career planning shifts, family milestones, unexpected turns. Financial literacy acts as a reliable compass during these moments. Whether you’re starting a new job, welcoming a new member to the family, or facing unexpected challenges, a solid financial understanding ensures smoother navigation through life’s varied terrains.

Building Resilience in Financial Crises

Crises can cast a shadow at any time. Financial literacy is like a sturdy umbrella that shields individuals from the downpour of economic uncertainties. In times of financial turbulence, those well-versed in the language of money can weather the storm more effectively, making informed choices and steering their ship to calmer waters.

The Economic Impact

Financial Literacy and Economic Stability:

Picture a society where individuals make informed financial decisions, steering clear of the pitfalls of debt and financial insecurity. This isn’t a utopian dream but a tangible reality when financial literacy takes center stage. By equipping individuals with the knowledge to navigate economic challenges, we lay the foundation for collective economic stability.

Boosting National Economies:

Economic engines roar to life when citizens comprehend the nuances of personal finance. Informed consumers contribute to a robust economy, driving demand intelligently and participating actively in investments. The ripples of financial literacy extend beyond individual bank accounts; they resonate in the national economic symphony.

Reducing the Wealth Gap:

Financial literacy acts as a bridge, spanning the gap between economic classes. When individuals from diverse backgrounds understand the principles of wealth creation and management, the chasm between the affluent and the less privileged begins to narrow. Empowering all members of society with financial knowledge is a potent tool for fostering economic equality.

The Educational Aspect

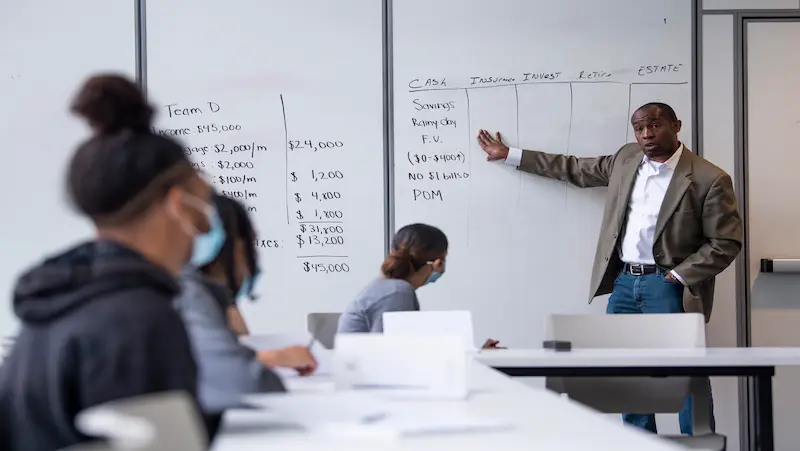

Financial Literacy in Schools:

Picture this: a classroom where students aren’t just memorizing equations, but also mastering the art of budgeting and understanding the language of investments. Embedding financial literacy in school curricula is akin to providing young minds with a compass to navigate the financial landscapes they’ll encounter beyond the school gates. It’s not just about grades; it’s about empowering the next generation with skills that will serve them for a lifetime.

Lifelong Learning and Adaptability:

Learning doesn’t end when the school bell rings. The world is a dynamic classroom, and financial literacy extends beyond textbooks. Embracing the spirit of lifelong learning strategies, individuals continually adapt to new financial scenarios, evolving with the ever-changing economic landscape. It’s about fostering a mindset that is both curious and resilient—a mindset that can weather financial storms and seize opportunities.

Preparing the Future Workforce:

The workplace of tomorrow demands more than just technical expertise. Employers seek individuals who understand the intricacies of financial decision-making, be it managing resources efficiently or making informed investment choices. The infusion of financial literacy into higher education isn’t just about personal finance; it’s about molding a workforce equipped to navigate the financial intricacies of the professional realm.

Personal Finance and Decision-Making

Making Informed Financial Choices

In the grand symphony of personal finance, decisions are the notes that shape our financial melody. From budgeting to investing, every choice plays a part. The key is to be informed. Take the time to understand the options, weigh the risks and rewards, and make choices that align with your goals. It’s not just about spending or saving; it’s about crafting a financial narrative that resonates with your aspirations.

Avoiding Debt and Financial Pitfalls

Debt can be a formidable foe in the journey to financial stability. It’s easy to fall into its clutches, but escaping its grip requires vigilance. Understanding the types of debt, managing credit wisely, and distinguishing between good and bad debt are essential skills. By navigating these financial minefields, you pave the way for a more secure and stress-free financial future.

Planning for a Secure Retirement

Retirement might seem like a distant dream, but the sooner you start planning, the brighter that dream becomes. It’s not just about stashing away money; it’s about understanding the power of compounding, exploring investment avenues, and envisioning the lifestyle you desire in your golden years. Planning for retirement is an investment in the life you want to lead long after the daily grind has ceased.

Entrepreneurship and Business

Fostering Financially Savvy Entrepreneurs

Embarking on the entrepreneurial path is a thrilling venture. Imagine if every entrepreneur had a financial compass guiding their way! Whether you’re launching a tech startup or a cozy cafe, understanding the financial landscape is key. From budgeting for the initial launch to navigating profit margins, being financially savvy lays the foundation for sustained success.

Enhancing Small Business Success

Small businesses are the heartbeat of communities. Knowing how to manage finances ensures these enterprises not only survive but thrive. Small business owners, equipped with financial literacy, can make strategic decisions about investments, pricing, and expansion. It’s about turning passion into profit while keeping the balance sheet in harmony.

Financial Literacy in Corporate Environments

Zooming into the corporate realm, financial literacy isn’t just for entrepreneurs; it’s a game-changer for everyone. From understanding the company’s financial health to making informed investment choices in benefit plans, employees empowered with financial knowledge are better positioned for a secure future.

Financial Literacy and Technology

Digital Financial Tools

Picture this: managing your budget with a few taps on your smartphone. Digital financial tools are not just convenient; they’re game-changers. Apps and platforms offer real-time insights into spending, saving, and investing. It’s your financial planner in your pocket, helping you stay on top of your game.

The Rise of Fintech

Fintech, the cool kid on the financial block, is reshaping the way we interact with money. From peer-to-peer lending to robo-advisors, fintech innovations are breaking down traditional barriers. It’s not just about accessibility; it’s about democratizing finance, making it a savvy friend for everyone, not just the elite few.

Online Education and Resources

In the era of information, ignorance is a choice. Online education and resources empower us to be masters of our financial fate. Webinars, blogs, and interactive courses bring an introduction to financial literacy to our fingertips. No need for a suit and tie – just a curious mind and a Wi-Fi connection.

Overcoming Barriers to Financial Literacy

Addressing Socioeconomic Disparities

Money matters should not be a privilege; they should be a universal right. Bridging the gap starts by recognizing and dismantling the barriers that socioeconomic differences often impose. Education tailored to different economic backgrounds can empower individuals, ensuring that financial wisdom is accessible to all, regardless of their economic standing.

Cultural and Linguistic Considerations

Our world is a mosaic of cultures and languages. To truly embrace financial literacy, we must tailor our approach to diverse cultural norms and linguistic nuances. By breaking down language barriers and understanding the cultural context, financial education becomes more relatable and applicable to a broader audience.

Accessibility and Inclusivity

Financial literacy is a beacon guiding everyone toward a secure future. However, this beacon must be visible to all. Efforts should be made to make financial resources and education accessible. This involves utilizing technology, creating user-friendly platforms, and promoting inclusivity so that everyone, irrespective of physical or technological limitations, can partake in the journey towards financial empowerment.

Financial Literacy and Sustainable Living

Environmentally Responsible Financial Choices

Every dollar we spend is a vote for the kind of world we want to live in. Financial literacy extends beyond balancing budgets; it’s about making choices that align with our environmental values. From supporting eco-friendly businesses to opting for energy-efficient appliances, our daily spending habits can be a powerful force for positive change.

Ethical Investments and Impact on Communities

Investing isn’t just about growing wealth; it’s about investing in a better world. Ethical investments consider the social and environmental impact, fostering positive change in communities. Whether it’s supporting local businesses or investing in companies with strong sustainability practices, our financial decisions can be a force for good.

Promoting Sustainable Financial Practices

Sustainability isn’t a buzzword; it’s a lifestyle. Financial literacy empowers us to adopt sustainable practices, reduce waste, and make mindful choices. From budgeting for reusable products to understanding the long-term benefits of eco-friendly investments, being financially literate means being environmentally conscious.

The Future of Financial Literacy

Trends in Financial Education: Beyond the Basics

Financial education is no longer confined to textbooks and classrooms. The future promises a shift towards practical, real-world applications. Interactive platforms, gamified learning experiences, and personalized content will redefine how we absorb financial wisdom. The emphasis is on making financial education not just informative but engaging, ensuring that the lessons resonate and endure.

Technological Advancements: Bridging Gaps with Innovation

In the age of rapid technological evolution, introduction to financial literacy is set to harness the power of innovation. Fintech solutions, from budgeting apps to investment platforms, will become integral in shaping individuals’ financial landscapes. Embracing these tools will not only simplify financial management but also empower individuals to make informed decisions in an ever-changing economic environment.

Advocacy and Policy Development: Paving the Way for Progress

As we gaze into the future, the role of advocates and policymakers becomes increasingly pivotal. There is a growing recognition of the need for comprehensive financial education at both the grassroots and institutional levels. Advocacy groups will play a crucial role in driving initiatives that make financial literacy a societal cornerstone, ensuring that individuals from all walks of life are equipped with the knowledge to navigate the complexities of personal finance.

Conclusion

In the tapestry of financial literacy, our journey isn’t measured in miles but in lessons learned, choices made, and a constant commitment to growth. It’s a lifelong adventure, not confined to textbooks or classrooms but woven into the fabric of our daily lives.

As we navigate this winding road, let’s remember: financial literacy is not a destination; it’s a compass guiding us through the complexities of a dynamic world. So, here’s to the ongoing journey—may it be filled with curiosity, resilience, and the wisdom to shape a future where financial empowerment is not just a goal but a way of life.

To get your hands on more educational and free resources on coding for kids, robotics for kids, financial education for kids, etc., do check out the BrightCHAMPS Page now!

Frequently Asked Questions

A1. Financial literacy is understanding how money works, from budgeting and saving to investing and managing debt. It’s about making informed and effective financial decisions.

A2. An understanding of financial literacy is crucial for navigating life’s financial challenges. It empowers you to make informed decisions, plan for the future, and achieve your financial goals.

A3. Start small! Begin with basic budgeting, explore online tutorials, read personal finance books, or attend workshops. Learning about introduction to financial literacy is a gradual process that builds over time.

A4. Basics like budgeting, saving, understanding credit, managing debt, and the importance of investing are fundamental financial literacy concepts to grasp initially.

A5. Absolutely! Consider books like “The Total Money Makeover” by Dave Ramsey, websites like Investopedia, or apps like Mint for budgeting. These resources offer practical insights for beginners diving into financial literacy.

We are an army of educators and passionate learners from BrightChamps family, committed to providing free learning resources to kids, parents & students.

We are an army of educators and passionate learners from BrightChamps family, committed to providing free learning resources to kids, parents & students.