Today, many people are very fond of playing games and are even addicted. The truth is, games were created to entertain people. Even today, there are many games that are deliberately designed to challenge your competitive side. As a result, there are lots of simulation-themed games that are pretty mind-blowing and quite challenging.

Teaching Kids About Money can be a hassle and parents might get confused to find interactive and engaging ways to inculcate their kids about this important life skill. Through this article, we will share some financial literacy games for kids that will help you with this task.

Financial literacy games for kids are usually presented with a business theme. Realistic business simulation games can teach you the practical basics of managing a business. The main objective of this educational game is to develop managerial skills and experience in creating a successful business.

Money games for kids also generally ask you to start a business from scratch and slowly develop it. The game’s difficulty level and obstacles vary depending on the level. For some games, you just need to follow the storyline and solve the odd things. What are you curious about? Here, the WowKeren team summarizes 7 business games that are suitable for those of you who like challenges. Let’s listen!

Table of contents

Learning Financial Literacy through Games

Picture this: a world where financial literacy is not a dreary subject filled with numbers and jargon, but an exciting adventure full of thrills, challenges, and rewards. Welcome to the realm of learning financial literacy through games!

Gone are the days of tedious lectures and dry textbooks. Today, we have a treasure trove of interactive games that effortlessly teach kids the ins and outs of money management while keeping them entertained and engaged. These games are like secret agents of financial education, disguising valuable lessons in the form of fun quests, virtual economies, and strategic decision-making.

Imagine your little ones embarking on epic quests as they navigate virtual worlds, battling budgeting monsters and saving the day with their savvy financial skills. They become masters of budgeting, learning to allocate their virtual currencies wisely, making every coin count, and resisting the temptation of impulse buying. It’s like witnessing their financial genius unfold before your eyes.

But it’s not just about defeating dragons and accumulating wealth; these games teach kids about the real-world implications of their financial choices. They learn the importance of saving for a rainy day, investing for the future, and distinguishing between needs and wants. These valuable life lessons become ingrained as they strive to build their virtual fortunes, setting a solid foundation for their real-life financial success.

Why financial literacy games for kids?

What makes these games truly remarkable is their ability to foster collaboration and competition. Kids can join forces with friends or family members, forming teams to conquer financial challenges together. They learn the power of teamwork, negotiation skills, and the art of compromise, all while developing their financial acumen.

And let’s not forget the addictive nature of these games. As kids level up, unlock achievements, and reap virtual rewards, their motivation skyrockets. They’re driven to learn more, explore deeper, and unlock the secrets of financial wizardry. Before you know it, they’ll be discussing stocks at the dinner table and offering sound financial advice to their peers.

So, embrace the power of play and unlock the vault of financial knowledge for your little ones. Let them immerse themselves in these captivating financial literacy games and watch their financial prowess grow. It’s a journey where learning becomes an adventure, financial independence becomes the ultimate quest, and your child transforms into a fearless financial champion.

In this world of financial literacy games, the only limit is their imagination. So, grab your controllers, don your virtual armor, and embark on this thrilling adventure of learning financial literacy through games. The future of financial success awaits, one game level at a time!

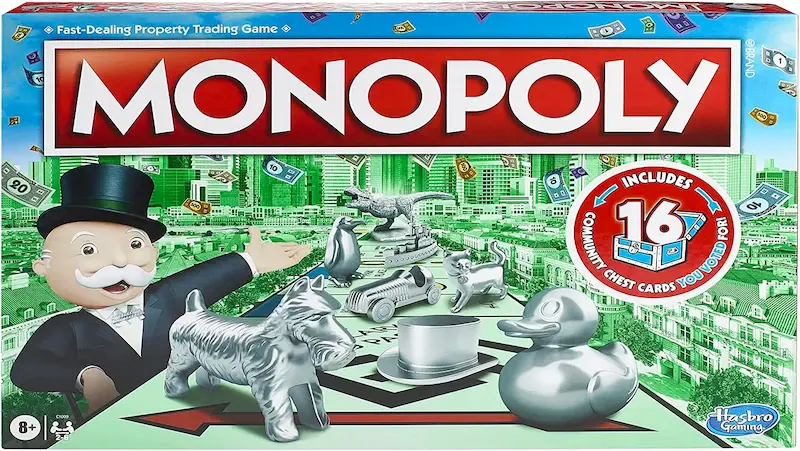

Monopoly

Who doesn’t know Monopoly? Board games that are often played by many people are now also available in the form of application games. Just like the board game version, this game allows gamers to negotiate, manage finances, prevent bankruptcy, take advantage of momentum, and defeat business opponents.

This game is almost the same as the one you used to play when you were little. Unfortunately, for each theme, you have to pay a certain amount of money, and each theme is not contained in the same application, so it seems wasteful of storage memory. It definitely aptly financial literacy games for kids that worth to be tried

Make It Rain: Love Of Money

Make It Rain: Love of Money is one the best Kids Money Games because, even though the gameplay offered is very simple, it basically teaches you the basics about money, which turns out to be very important. The way to play is very simple, you just swipe a piece of money from a large pile of money. Every dollar that you swipe successfully will enter your account. The goal is to collect as much money as you can.

It looks simple, but this financial literacy game for kids has taught me many things about money. This game makes players work hard to earn money, but once you earn enough money, you can invest and let the money work for you. This game is perfect for those of you who want to understand how rich people get their money.

Air Tycoon Online

This Android game is very complex and has many features that will hone your skills in doing business. Air Tycoon Online offers games where you manage an airline. The flight routes that you can open in this game are not only limited to one city but all over the world.

The basics of business in this game are very complete if you are interested in experiencing the airline business. This can happen because, in this financial literacy game for kids, you will find out what is needed to open an airline. In fact, you will be given technical knowledge about the technology of an airplane as a whole.

Billionaire

Billionaire is a simple game with one main goal, namely to become the richest person in the world by dominating several business sectors at once. Through these financial literacy games for kids, you will be given initial capital to make a business investment by selling services or goods, just like in the real world.

As an example, you can build a shop that sells hot dogs, lemons, and even gifts. All of these business units become a form of capital conversion, which is given to multiply the capital and obtain profits. This game will help you understand the basics of opening a business from zero to a million.

TradeHero

An application that simulates the rules, games, and fluctuations of stock prices according to the real world. Issuer companies are also popular companies such as Apple, Coca-Cola, Sony, Nike, and so on. With this game, you will learn to deal with stock game situations where the rules are exactly the same as in the real world.

Even cooler, the ups and downs of the stock prices listed in the game are adjusted to the company’s stock prices in the real world. Through these financial literacy games for kids, you will learn the practice of investing in stocks directly and how to invest in stocks directly. Unfortunately, this game is not available on Google Play but only on the Apple App Store.

Cooking Academy: Restaurant Royale

This game has the concept of managing a restaurant business. Cooking Academy: Restaurant Royale provides business lessons where, in managing a restaurant, you must be able to take into account various aspects so that the business can provide significant profits.

These aspects are very important because what customers evaluate about a restaurant is the taste of the food served. If you serve bad food to customers, of course, they will not choose your restaurant as a recommendation for places to eat. Through this game, you will learn various aspects of success in doing business, little by little.

My Supermarket Story

My Supermarket Story is a business simulation-themed game, where you will manage a supermarket to make it a big and complete supermarket. To manage the supermarket, of course, you can sell a variety of different items and also unlock various other items that are much more profitable.

Apart from that, you can also bring in several superstars to attract the attention of visitors. You will face various challenges and obstacles in this game. But you are also required to continue to innovate so that your business continues to grow and face these challenges.

Roller Coaster Tycoon

Roller Coaster Tycoon is a game that is certainly familiar to those of you who are fans of simulation games. As an adaptation for the mobile version, of course, this series is quite successful.

In this game itself, you have the task of building your own playground by collecting hundreds of different rides, restaurants, shops, and various decorations provided. Of course, this game can be the right one if you have high creativity.

Conclusion

And there you have it, a treasure trove of financial wisdom wrapped in an exciting package of games! These financial literacy games for kids are not only a blast to play, but they also plant the seeds of money management skills that will sprout into a lifetime of financial success.

Now, imagine your little one eagerly grabbing the dice, navigating through virtual worlds, and making strategic decisions that would make even Wall Street wizards proud. Through these games, they’ll learn to save, invest, budget, and make smart financial choices—all while having a blast with their friends or family.

So, parents and educators, why not join the fun? Embrace the power of play and unleash the financial genius within your young ones. Whether they become a tycoon in Monopoly, a savvy entrepreneur in Lemonade Stand, or a wise investor in Stockpile, these games will foster a love for learning about money that will transcend the boundaries of the virtual world.

Remember, financial literacy is not just about dollars and cents; it’s about empowering our children with the knowledge and skills to navigate the complex landscape of personal finance for kids. So let’s roll the dice, click that mouse, and embark on this exciting adventure together. The world of financial literacy games awaits, ready to transform our children into financial superheroes.

So go ahead, unleash the power of play, and let the games begin! Also, don’t forget to check out this blog, where we empower the future with essential financial education for kids, nurturing their financial confidence from an early age!

Since we are talking about teaching our kids financial literacy in a fun way, why not try the Money Lessons by Brightchamps App that teaches your kids about saving, budgeting, and spending through fun interactive games and lessons!

Frequently Asked Questions

Absolutely! Teaching children about money is highly beneficial as it equips them with essential life skills. Financial education empowers children to make informed decisions, develop healthy spending habits, and build a strong foundation for financial independence in the future.

It varies. While some parents actively teach their children about money, others may overlook its importance. It’s crucial for parents to take an active role in their child’s financial education to ensure they learn important concepts like budgeting, saving, and investing.

Yes, parents should have open conversations about money with their kids. Discussing financial topics helps children develop a healthy relationship with money, understand its value, and learn how to manage it responsibly.

It depends on the situation. While shielding children from financial hardships can be tempting, age-appropriate discussions about money problems can help them understand the family’s financial situation and encourage empathy, resilience, and problem-solving skills.

Financial education can begin as early as preschool age. Introducing basic concepts like counting, identifying coins, and distinguishing needs from wants can lay the foundation. As children grow, topics like budgeting, saving, and responsible spending can be gradually introduced and reinforced.

It depends on personal preferences and circumstances. While disclosing specific numbers may not always be necessary, sharing general information about the family’s financial situation can help children grasp the concept of money and develop a realistic understanding of its role in their lives.

There can be various reasons why parents avoid discussing money. It could stem from cultural taboos, personal discomfort, lack of financial knowledge, or the assumption that children are too young to understand. However, open communication about money is crucial for children’s financial well-being.

Incorporating practical experiences, such as giving them an allowance, encouraging saving through piggy banks, involving them in budgeting decisions, and playing financial literacy games, can make learning about money fun and engaging. Additionally, modeling responsible financial behavior and having regular conversations about money are effective teaching methods.

Teaching children the value of money instills essential life skills and financial literacy. It helps them understand the importance of hard work, delayed gratification, and responsible decision-making. Learning about money empowers children to become financially independent and make informed choices throughout their lives.

Rich parents often prioritize teaching their children about financial literacy, wealth creation, and the principles of investing. They focus on cultivating an entrepreneurial mindset, teaching the value of building assets, and instilling a strong work ethic. Rich parents also emphasize long-term financial planning and philanthropy as part of their children’s money education.