We get to see everyone using an app for something or the other. Life seems to be easy with apps and teaching can be fun as it keeps the students interested. Learning can be made wonderful using technology that gives a very practical approach to learning by doing it.

The financial tools being user-friendly can make it easy to expand financial literacy knowledge. The kids’ journey from getting pocket money or an allowance to getting a paycheck requires their financial smartness and helps them understand that even small savings counts can be done through age-appropriate tools like cartoon characters, games, activities, and trackers to build up good financial habits.

The first financial organizer any kid uses is a piggy bank where kids keep their loose change and pocket money. The piggy Bank is a tool to induce savings as kids feel happy filling it up with coins and notes. The children watch how saving a penny regularly can collect a big amount.

Table of contents

Introduction

In this digital era, piggy banks have also become smart and digital which help a child to track the amount collected and give push notifications to the parents when it is time to give allowance to the child.

The child learns that money is to be saved first and then spent. At any point in time, they can check how far they are from reaching a financial goal and this cultivates a habit of savings and spending right from childhood. It also encourages healthy money conversations among family members.

Getting an allowance instills a sense of financial freedom among kids and helps them to learn that a penny does not come for free as we need to work for it. This teaches them how important it is to save money and use it wisely.

They learn to manage and save money independently and smartly within the money they earn. The apps help parents find out when to add money to the linked prepaid cards or wallets without the need for their children to ask them for it.

Benefits of using financial tools to teach kids about money

Interactive and Interesting Learning Environment:

Children may find the traditional approaches to teaching financial literacy boring and abstract. However, financial tools make use of gamification and technology to produce interactive and interesting learning experiences.

Financial education tools attract the interest and curiosity of young brains by using engaging activities, quizzes, and colorful graphics to make learning fun. This strategy increases long-term engagement and active participation while also improving students’ comprehension of financial topics.

Hands-on Money Management:

Financial tools give kids a digital platform to sharpen their money management techniques in a safe setting. Kids can gain financial literacy through simulations and virtual accounts that teach them how to save, budget, and make wise purchases.

They can create financial objectives, monitor their progress, and comprehend the effects of their decisions thanks to these tools. Finance tools enable kids to make responsible financial decisions from an early age by giving them a sense of autonomy and responsibility.

Real-Time Feedback and Reinforcement:

The prompt feedback that financial instruments offer is one of their key benefits. Children who use these tools get immediate feedback on their choices and activities with regard to money. This feedback process helps kids comprehend the effects of their decisions and reinforces beneficial behaviors. Children may see the results of their activities up close, encouraging a sense of accountability and responsibility. Examples include saving a particular amount, adhering to a budget, or making sensible investment decisions.

Practical Knowledge Application:

Financial instruments bridge the conceptual and practical knowledge gaps through practical knowledge application. They enable kids to use the financial ideas they study in practical contexts. Kids can practice making purchases, evaluating costs, and comprehending value for money, for instance, through virtual storefronts or online marketplaces.

They can explore the stock market, model investments, and learn the fundamentals of risk and reward with the use of financial instruments. Through this practical training, individuals get the self-assurance and knowledge they need to succeed in the future’s complex financial environment.

Piggy Banks

For many years, piggy banks for kids have served as a universal representation of saving and fiscal responsibility. Numerous people, both young and old, have developed a habit of saving money thanks to these straightforward yet powerful techniques.

Piggy banks have changed to meet modern needs in the digital age, including smart models that keep track of spending and savings. The classic and modern piggy banks will be examined in this blog post, along with the advantages of using them to teach children about money via money lessons for kids.

Traditional Piggy Banks:

A traditional piggy bank is a physical object, frequently made of ceramic, with a little slot for placing coins and bills. It has a long history and is a common method for storing spare coins.

Smart Piggy Banks:

Technology improvements have led to the introduction of smart piggy banks, which provide a more engaging and educational saving experience. These contemporary versions frequently have digital displays, connectivity, and tracking capabilities.

Benefits of Using Piggy Banks to Teach Kids about Money:

Piggy banks are incredibly useful instruments for educating kids about managing their money. Here are several major advantages:

1. Interactive Learning: Piggy banks offer a practical way to learn about money. Children have the ability to physically handle money, calculate their savings, and observe the results of their labors in real-time. Understanding and retention are aided by this concrete experience.

2. Savings Habits: By using piggy banks, kids form a consistent saving habits. The ritual of putting money in the piggy bank teaches children valuable financial discipline at a young age. You can also start a saving bank account for kids and encourage to save money on the account.

3. Setting Goals: Piggy banks help kids develop their goal-setting abilities. Children may set goals and watch as their piggy banks fill up, whether they are saving for a special treat or a toy. This procedure encourages endurance, tenacity, and delayed reward.

4. Money Management Skills: Children learn about budgeting, spending, and saving through piggy banks. They acquire crucial money management skills for the future as they learn to make decisions about what to save for and how to allocate their funds.

Allowance Apps

The era of piggy banks and loose change is over. Allowance apps have become popular in this digital age as a practical and instructive way for kids to manage their pocket money. These cutting-edge gadgets not only make it simpler for parents to distribute money, but they also impart important financial responsibility skills to children.

In this article, we’ll explore the world of allowance applications, showcasing the features and advantages of well-known choices including RoosterMoney, FamZoo, and Greenlight.

RoosterMoney:

RoosterMoney is an allowance software that is simple to use and helps learn about money management for kids. It offers young consumers an engaging experience with a virtual dashboard and vibrant images. The following are some of RoosterMoney’s standout features:

a) Automated Allowance: By setting up regular, automatic payments to their kids, parents can do away with the need for actual cash exchanges.

b) Goal Setting and Savings: Children can set financial objectives, monitor their progress, and designate funds for savings, encouraging a sense of accountability and postponing gratification.

c) Tasks and chores can be assigned by parents using RoosterMoney, which enables kids to work hard and earn money.

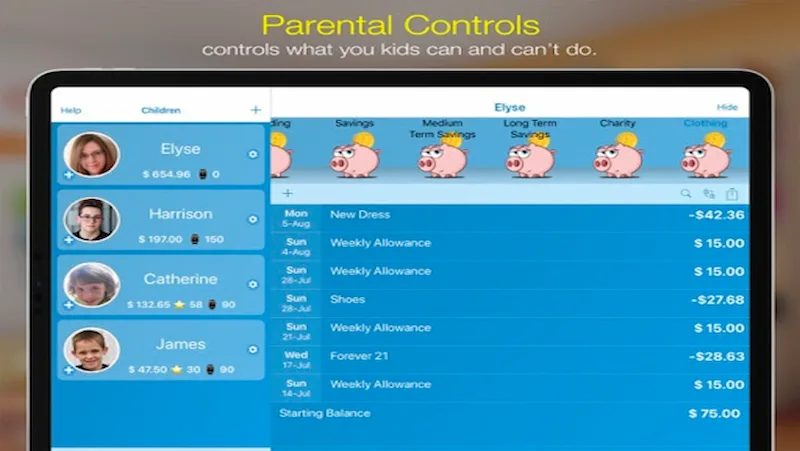

FamZoo:

Another well-liked allowance software, FamZoo, mixes prepaid cards with a fictitious family banking system. It provides a wide range of functions to teach children about personal money. FamZoo has a number of notable characteristics, such as:

a) Prepaid cards: these are linked to the app, and parents may load money onto them to provide their children the ability to make purchases both online and offline, up to a set amount.

b) Parental Controls: FamZoo offers effective parental controls that let parents keep tabs on their children’s spending, establish budgets, and promote wise financial decisions.

c) Customizable Family Banking System: Families can design their own “bank” within FamZoo, replete with interest rates, loans, and other financial instruments, encouraging a better comprehension of personal finance ideas.

Greenlight:

Greenlight is an allowance software that places a strong emphasis on financial education and gives kids the power to decide for themselves. It has distinctive elements that enhance financial literacy. The following are some important features of Greenlight:

a) Real-Time Monitoring: Parents can see in real-time what their kids are spending, which helps them model appropriate spending and provide guidance on money matters.

b) Parent-Paid Interest: Greenlight gives parents the option to choose interest rates for their kids’ money, which promotes the value of compound interest and the habit of saving.

c) Store-Specific Controls: To encourage wise financial practices, parents can personalize spending restrictions to place restrictions on which stores their kids can use the Greenlight card.

Budgeting apps

Budgeting apps for kids provide an interactive and engaging way to introduce young ones to the world of budgeting, saving, and responsible spending. In this blog, we will explore three popular budgeting for kids: iAllowance, BusyKid, and Bankaroo. Let’s dive in!

iAllowance:

Children may learn about money management by using the feature-rich budgeting programme iAllowance. This iOS software provides a straightforward yet efficient way to keep track of allowances, tasks, and spending. Key elements consist of:

a. Chore Management: iAllowance’s chore management feature enables parents to give their kids chores and specify the monetary rewards that go along with them. Children will learn the value of earning money through responsibility and hard work from this feature.

b. Savings Goals: Children can use the app to create savings goals and visually track their progress. This function encourages sensible spending and supports the development of a saving habit.

c. Customizable Allowances: iAllowance’s customizable allowance features let parents set allowance amounts, frequency requirements, and even consequences for missing duties. With this flexibility, parents can adapt the app to the requirements and regulations of their own families.

BusyKid:

Designed to teach kids about earning, saving, and giving, BusyKid is a comprehensive budgeting tool. It provides a platform for parents to teach their children about employment and financial management. The following are some of BusyKid’s standout features:

a. The Chore Marketplace: which enables kids to get money by doing tasks. It resembles a marketplace where children can browse various chores and pick the ones they are interested in. This strategy encourages independence and judgment.

b. Investment Options: By letting kids invest a percentage of their profits in actual stocks, BusyKid teaches kids about investment. This special feature gives children early exposure to practical investment principles.

c. Philanthropy: By donating a portion of its profits to a user-selected charity, the app promotes charitable giving. BusyKid fosters a sense of social responsibility and instills the value of assisting others.

Bankaroo:

Specifically created for kids, Bankaroo is a virtual bank and budgeting tool. By giving them a virtual banking experience, it seeks to teach children about personal money. Key elements consist of:

a. Account management: Bankaroo gives kids access to a virtual bank account via which they may keep tabs on their earnings, outgoings, and savings. This function gives users practical experience handling their personal finances.

b. Goal Setting: Using the app, children can create financial objectives like saving money for a toy or a future expenditure. Bankaroo encourages kids to save money and manage their spending by graphically illustrating progress towards these objectives.

c. Parental Involvement: Bankaroo enables parents to keep an eye on their kids’ money dealings, offering advice and supervision as necessary. This function encourages candid dialogue within the family concerning financial issues.

Financial Education games and activities

A crucial part of a child’s growth is financial education, which gives them the knowledge and abilities they need to make wise financial decisions. While the use of interactive games and activities can help make learning about finance fun and interesting for kids, traditional classroom instruction still plays a vital role.

In this blog post, we’ll look at several well-liked games and activities for financial education aimed at teaching kids about money management while having fun.

The Game of Life:

The Game of Life has been a beloved board game for years, and modernized versions of it still hold the attention of both kids and adults. Players in this game experience the journey of life while making choices regarding their employment, investments, and financial obligations.

Children learn about income, costs, budgeting, and the effects of financial decisions through games. Children can learn about the value of money in a practical setting by playing The Game of Life, which promotes strategic thinking.

Monopoly:

This classic board game also teaches important lessons about financial management. Players learn about budgeting, negotiating tactics, and risk assessment as they buy and sell homes, collect rent, and make strategic decisions. Through the game of Monopoly, children learn about property ownership, investing, and the effect of money choices on long-term wealth growth. Important ideas like rent, mortgages, and the necessity of conserving money for unforeseen emergencies are also introduced in the game.

Online Games:

Online games are a practical and engaging approach for kids to learn financial literacy in the modern digital world. Money Metropolis and Financial Football are two well-known online games with a financial management theme.

Money Metropolis:

Visa created the online game Money Metropolis to teach kids about earning, saving, and spending money sensibly. Players move through a virtual metropolis while accepting employment, controlling budgets, and making financial choices. Kids learn about personal finance, goal-setting, and making decisions that are in line with their financial aims through completing challenges and activities.

Financial Football:

Financial Football blends sports with financial education. It was developed by Visa and the National Football League (NFL). Players in this interactive game get yards for their football team by responding to financial questions. Financial Football covers a wide range of financial subjects, such as credit management, budgeting, saving, and investing. The game uses football’s widespread appeal to keep kids interested while reinforcing important money management skills.

Online Financial Education Resources for Parents and Educators

Children’s future prosperity depends on their being equipped with financial literacy abilities in the ever-changing digital world of today. Early financial education instills sound financial practices in children and equips them with the knowledge necessary to make wise decisions.

Fortunately, there are many internet resources that may assist parents and educators in teaching kids about money and developing solid money habits. In this article, we’ll look at some of the best online tools and sources for educating youngsters about financial literacy and money management.

FinChamps

Discover the fascinating world of FinChamps, a cutting-edge financial literacy program brought to you by BrightChamps. With FinChamps, children embark on a captivating learning journey where they become financial superheroes.

Through interactive games, engaging activities, and real-world simulations, FinChamps equips kids with essential money management skills, teaching them the value of saving, budgeting, and making wise financial decisions.

This dynamic program not only ignites a passion for financial literacy but also instills confidence, critical thinking, and problem-solving abilities. Join the FinChamps revolution and watch your child soar to new heights of financial intelligence and success.

Money as You Grow:

The Consumer Financial Protection Bureau’s (CFPB)’s Money as You Grow program offers a thorough and developmentally appropriate curriculum for kids of all ages. This website offers games, exercises, and discussion starters to keep kids interested while teaching them crucial financial principles. In order to make sure that the content is appropriate and interesting for each child’s developmental stage, the resources are grouped into various age groups.

Practical Money Skills:

Practical Money Skills is a user-friendly portal that provides a wealth of financial education tools for parents, teachers, and students. Practical Money Skills was created by Visa. Lesson plans, games, calculators, and articles on many financial topics are available on the website. Practical Money Skills offers educators and parents teaching materials that are geared toward different age groups.

National Endowment for Financial Education (NEFE):

The NEFE website is a useful tool for parents and teachers who want to teach their students about money management. Lesson plans, articles, and interactive games are just a few of the educational tools available. Additionally, NEFE offers thorough recommendations on how to teach financial education, assisting parents and teachers in understanding the most effective ways to teach financial literacy.

Money Smart for Young People:

Money Smart for Young People is a complete program for kids ages 5 to 18 that was created by the Federal Deposit Insurance Corporation (FDIC). The program offers age-appropriate lesson plans, crafts, and films to keep kids interested while teaching them about budgeting, saving, and money management. Parents and educators of all income levels can use Money Smart for Young People’s resources thanks to their availability as free online materials.

Conclusion

In conclusion, it is crucial for parents and educators to give kids the financial literacy skills they need to successfully navigate the intricacies of today’s society. Online materials provide a practical and accessible way to instruct children in financial literacy and money management.

The websites described above offer a plethora of information and tools to empower kids with the knowledge and skills they need for a financially secure future, whether you’re seeking interactive games, lesson plans, or thorough curricula. By utilizing these resources, parents and educators can have a significant impact on how the future generation will handle money.

Finchamps by BrightChamps is an extraordinary educational program that ignites children’s learning potential through a unique blend of innovation and creativity. With its captivating curriculum and expertly designed activities, Finchamps sparks curiosity and fosters critical thinking skills.

Each child is encouraged to explore and develop their own talents while receiving personalized guidance from dedicated mentors. Finchamps is truly a transformative learning experience that empowers young minds to shine brightly and embrace a world of endless possibilities.

Frequently Asked Questions (FAQs)

Yes, it is feasible to achieve financial independence while having kids. Even though having children comes with more financial obligations, with careful planning, budgeting, and long-term financial objectives, it is still feasible to become financially independent.

A child’s financial independence might develop at a different age based on their unique situation and cultural norms. Typically, a child’s teenage years are when they start to learn how to manage their finances independently. To be completely financially independent, though, may take longer, and it’s typical for young adults to continue getting support from their parents even after they’ve reached adulthood.

Teaching children financial independence requires a combination of education, guidance, and hands-on experience. Here are some tips:

1. Start early: Introduce basic financial concepts at an age-appropriate level.

2. Teach budgeting: Help your child understand the importance of budgeting by giving them a regular allowance or helping them earn money through chores.

3. Encourage saving: Teach the value of saving by setting up a savings account and discussing short-term and long-term financial goals.

4. Introduce earning and spending: Teach your child about the connection between work and money, and help them make informed spending decisions.

5. Foster responsibility: Encourage your child to take ownership of their financial choices and consequences.

Setting your child up for financial success involves a holistic approach that encompasses various aspects of their financial well-being. Here are some strategies to consider:

1. Education: Emphasize the importance of education and encourage your child to develop valuable skills for future employment.

2. Savings and investments: Teach your child the habit of saving and introduce them to the concept of investments to help grow their wealth over time.

3. Financial literacy: Provide opportunities for your child to learn about personal finance, including budgeting, saving, investing, and managing debt.

Splitting finances with kids typically involves teaching them about money management, allowances, and saving. Here are some tips to help you navigate this process:

1. Introduce financial responsibilities: As children grow older, gradually introduce financial responsibilities such as contributing to specific expenses or saving for larger purchases.

2. Establish an allowance system: Decide on a suitable amount to give your child regularly, considering their age, needs, and family financial situation.

3. Teach budgeting: Encourage your child to create a budget by dividing their allowance into spending, saving, and sharing categories.

Securing your child’s financial future involves taking proactive steps to provide stability and opportunities for their long-term well-being. Here are some essential strategies to consider:

1.Start early: Begin planning and saving for your child’s future as soon as possible. The earlier you start, the more time you have to build a strong financial foundation.

2.Education planning: Consider setting up an education savings account, such as a 529 plan or a dedicated savings account, to save for your child’s future education expenses.

3.Life insurance: Explore life insurance options to provide financial security for your child in case of unexpected events.

Preparing your child for their financial future involves equipping them with knowledge, skills, and values that will serve them well throughout their lives. Consider the following steps:

1.Teach basic financial concepts: Introduce your child to concepts such as money, earning, saving, spending, and budgeting from an early age.

2.Encourage savings habits: Help your child develop a habit of saving by setting up a savings account and encouraging them to save a portion of their money regularly.

3.Promote goal setting: Teach your child to set financial goals and work towards them, whether it’s saving for a toy, a college education, or a future business.

We are an army of educators and passionate learners from BrightChamps family, committed to providing free learning resources to kids, parents & students.

We are an army of educators and passionate learners from BrightChamps family, committed to providing free learning resources to kids, parents & students.