In the whirlwind of high school life, it’s easy to overlook a skill that could shape our futures—financial literacy. Beyond the textbooks and exams, understanding money is a compass guiding us through adulthood. From budgeting allowances to deciphering student loans, the knowledge we gain now sets the stage for a financially savvy journey ahead. So, why are financial literacy projects for high school students crucial? Let’s dive into this blog and sense of it all.

Table of contents

- Budgeting for Beginners

- Project 1: Create a Personal Budget

- Project 2: Savings Challenge

- Project 3: Introduction to Banking

- Project 4: The Credit Game

- Project 5: Entrepreneurship 101

- Project 6: Understanding Taxes

- Project 7: College and Student Loans

- Project 8: The Psychology of Money

- Project 9: Real-World Financial Scenarios

- Project 10: Financial Literacy in Pop Culture

- Benefits of Financial Literacy Projects

- Conclusion

- Frequently Asked Questions

Budgeting for Beginners

So, you’ve got that hard-earned cash in your pocket, but where does it go? Let’s talk budgeting—your financial GPS. Break down your spending, set limits, and avoid the budget black hole.

Saving and Compound Interest: Planting Seeds for the Future

Ever heard of compound interest? It’s like magic for your savings. Start early, save consistently, and watch your money grow on its own. Think of it as your personal money tree—it’s all about the long game.

The Power of Investing: Turning Pocket Change into Financial Muscle

Investing isn’t just for Wall Street types. Learn the ropes, dip your toes into the investment pool. Whether it’s stocks, bonds, or real estate, make your lesson plan on money work for you. It’s not about having a fortune to start; it’s about starting to build a fortune.

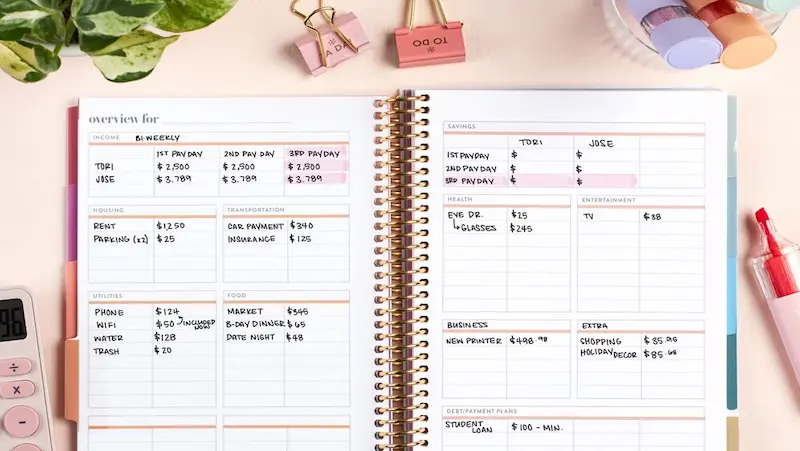

Project 1: Create a Personal Budget

Welcome to the first step towards financial empowerment! Building a personal budget might sound like a daunting task, but fear not – it’s an essential skill that puts you in control of your money. Let’s break it down together with a step-by-step guide.

Step-by-Step Guide to Building a Budget

1. Track Your Income: Start by listing all your sources of income. This includes allowances, part-time jobs, or any other money you receive regularly.

2. Identify Your Expenses: Break down your spending into categories like groceries, entertainment, transportation, etc. Be thorough to ensure nothing is overlooked.

3. Fixed vs. Variable Expenses: Differentiate between fixed expenses (like rent or mortgage) and variable expenses (like dining out). This helps prioritize and manage costs effectively.

4. Set Realistic Goals: Define your financial goals. Whether it’s saving for a gadget or planning for future education, having clear objectives guides your budget.

5. Allocate Your Income: Assign specific amounts to each spending category based on your income and priorities. This ensures you’re living within your means.

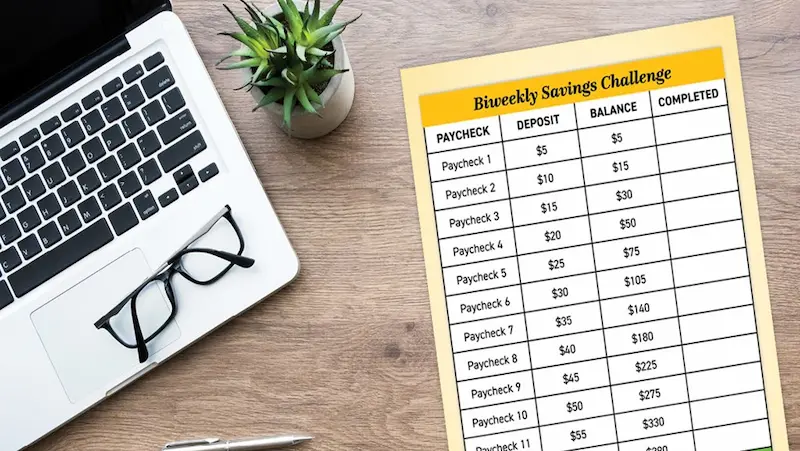

Project 2: Savings Challenge

Setting Savings Goals: Dream Big, Start Small

In the grand scheme of things, setting savings goals is like drawing up a treasure map. Where’s ‘X’ marks the spot for your financial dreams? Dream big, but let’s be real – Rome wasn’t built in a day. Break down those big dreams into bite-sized, achievable goals. Whether it’s that dream vacation, a down payment on a cozy nest, or just a rainy-day fund, make it specific, measurable, and, most importantly, realistic.

Tracking Progress: The Journey Is the Destination

Now, onto the nitty-gritty of our adventure – tracking progress. Think of it as your very own financial Fitbit. Set up a system that works for you, be it a trusty spreadsheet or a savings app. Regular check-ins keep you accountable and motivated. Celebrate the small wins – that’s like finding hidden treasures on your journey. Did you resist that tempting impulse buy? Treat yourself to a metaphorical gold star.

Rewards: Because You Deserve It

Speaking of treats, let’s talk rewards. Every explorer needs a reward, right? Set milestones along the way and treat yourself when you reach them. It could be a guilt-free coffee from your favorite cafe, a movie night, or whatever floats your financial boat. The key is to make it enjoyable without breaking the bank. After all, what’s the point of the adventure if you can’t savor the victories?

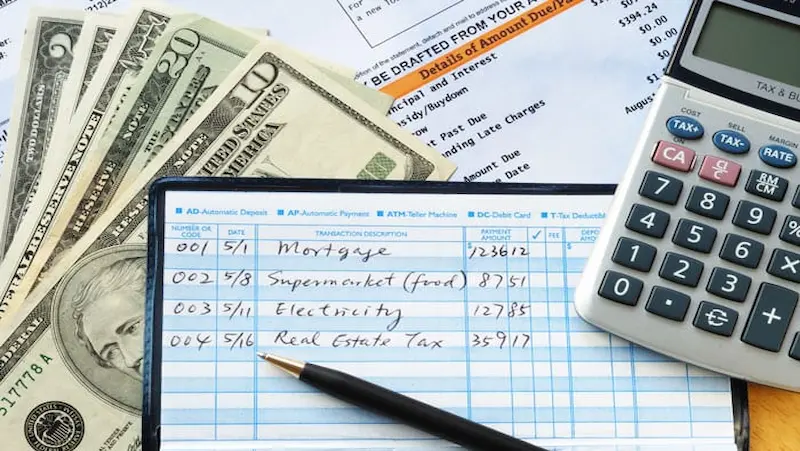

Project 3: Introduction to Banking

Opening a Bank Account

Opening a bank account is like securing a home for your hard-earned money. It’s the first step towards financial independence. Whether you’re a student, professional, or a seasoned individual, the process is surprisingly straightforward. Head to your local bank armed with a government-issued ID, social security number, and a sense of purpose. The friendly folks at the bank will guide you through the paperwork, helping you choose between the variety of accounts available.

Pro tip: Opt for a checking account for everyday expenses and a savings account for those future goals. It’s like having separate pockets for your coffee money and your dream vacation fund.

Managing a Checking and Savings Account

Once your accounts are up and running, it’s time to get cozy with managing them. Your checking account is your financial command center – where your salary lands and your bills take off. Keep an eye on your transactions, and embrace the power of digital banking apps. They’re like a personal assistant for your finances, alerting you to every purchase and helping you stay within budget.

And then there’s your savings account, the unsung hero of financial planning. Set aside a percentage of your income as a monthly contribution to your savings. Trust me; future you will thank you for this habit. It’s the secret sauce to tackling unexpected expenses or seizing those spontaneous opportunities.

Project 4: The Credit Game

Understanding Credit Scores

Ah, credit scores – those mysterious numbers that wield so much power over our financial lives. But fear not, my friends, for decoding the credit score enigma is not as elusive as it seems. Think of it as a report card for your financial responsibility, with scores typically ranging from 300 to 850.

Payment history, credit utilization, length of credit history, types of credit, and new credit – these are the pillars supporting your credit score. Pay your bills on time, don’t max out those credit cards, maintain a mix of credit types, and avoid too many new credit inquiries. Voila! You’re on your way to mastering the credit score game.

Responsible Credit Card Usage

Now, let’s talk plastic – credit cards, that is. They can be your financial games for students and your financial best friend or your worst enemy, depending on how you wield their power. The key? Responsible usage.

First and foremost, treat your credit card like a hot potato – don’t carry a balance if you can help it. Pay those bills in full and on time to keep that credit score shining. And here’s a little secret: aim to keep your credit utilization below 30%. That means if your credit limit is $1,000, try not to carry a balance higher than $300.

It’s also wise to diversify your credit portfolio. Mix it up with different types of credit, like credit cards and installment loans, to showcase your ability to handle various financial responsibilities.

Project 5: Entrepreneurship 101

The Spark of an Idea

Every journey begins with a spark, and yours is no different. It’s that unique concept, the solution to a problem or a product that people didn’t know they needed. Now, how do you turn that spark into a full-blown flame?

Crafting Your Blueprint: The Business Plan

Think of your business plan as the roadmap to your success. It’s not just a formality; it’s the heartbeat of your venture. This document outlines your goals, target audience, competition, and how you plan to navigate the entrepreneurial terrain. It’s your pitch to investors, your guide in the storm.

Building the Foundation

Starting small doesn’t mean thinking small. Lay a solid foundation for your business. Understand your market, define your unique selling proposition (USP), and be crystal clear about your mission. These basics will be the pillars that hold your business up, rain or shine.

Numbers, Numbers, Numbers

Even if you’re not a fan of math, the financial side of things is non-negotiable. Budgets, projections, and cash flow—these are your new best friends. Keep an eagle eye on your finances to ensure your business not only survives but thrives.

Embrace the Learning Curve

Starting a business is a rollercoaster. There will be highs and lows, loops you didn’t see coming, and thrilling moments that make it all worthwhile. Embrace the learning curve, be open to adapting, and remember: that every setback is a setup for a comeback.

Project 6: Understanding Taxes

Getting to Know Income Tax: A Brief Encounter

Income tax is the government’s way of getting its share of your earnings. Understanding the basics is crucial. Your income, whether from your job, investments, or other sources, is subject to taxation. But don’t fret; not all of it goes to the taxman. Tax laws often provide deductions and credits to ease the burden.

Filling Out the Tax Return: It’s Like a Financial Selfie

Imagine your tax return as a snapshot of your financial year. It captures your income, expenses, and any qualifying deductions or credits. The key is to be meticulous and honest in reporting. Don’t worry; you don’t need a degree in finance to navigate this. There are user-friendly tax software and professionals ready to guide you through the process.

Tips for a Smooth Tax Journey:

Organize Your Financial Records: Keep your income statements, receipts, and any relevant documents neatly organized. This not only makes the process smoother but also ensures you don’t miss out on potential deductions.

1. Stay Informed About Deductions: Be aware of deductions and credits you qualify for. This might include education expenses, homeownership benefits, or even energy-efficient home improvements.

2. Consider Professional Help: If your financial situation is complex, seeking the expertise of a tax professional is a wise move. They can provide valuable insights and help maximize your returns.

3. File on Time: The tax deadline is not one to be ignored. Mark it on your calendar and file your return on time to avoid penalties.

Project 7: College and Student Loans

Financial Planning for Higher Education

Before you set foot on campus, it’s essential to have a clear financial roadmap. Begin by researching the cost of tuition, accommodation, and other related expenses. Consider scholarships, grants, and part-time work opportunities. Create a budget that encompasses both academic and personal expenditures to ensure a realistic and sustainable financial plan.

Managing Student Loan Debt

Student loans are often a necessary means to fund education, but their management requires careful consideration. Understand the terms of your loans, including interest rates and repayment options. Strive to make timely payments to avoid accruing unnecessary debt. If possible, explore strategies like loan consolidation or refinancing to streamline your repayment process.

Project 8: The Psychology of Money

Exploring Money Mindsets

Your relationship with money is deeply personal and shaped by a myriad of factors – upbringing, experiences, and cultural influences. Understanding your money mindset is the key to unlocking healthier financial habits. Are you a spender or a saver? Do you see money as a source of security or a means of adventure? By exploring these questions, you’ll gain valuable insights into your financial decision-making processes.

Making Informed Financial Decisions

Armed with self-awareness, it’s time to make informed financial decisions. Project 8 equips you with the tools to navigate the intricate landscape of personal finance. From budgeting wisely to investing strategically, we guide you toward choices that align with your goals and values.

Project 9: Real-World Financial Scenarios

Case Studies on Financial Challenges

Real life isn’t always smooth sailing, especially when it comes to finances. Project 10 throws you into the deep end with case studies that mirror the diverse challenges individuals and businesses face. From unexpected expenses to strategic financial planning, these real-world scenarios provide a hands-on approach to understanding the complexities of managing money.

Problem-Solving and Decision-Making

The heart of Project 9 lies in cultivating problem-solving skills and mastering the delicate dance of decision-making. Because, let’s face it, life is filled with financial crossroads. Whether it’s choosing between investment options, navigating debt, or optimizing your budget, this project equips you with the tools to confidently tackle the financial maze.

Project 10: Financial Literacy in Pop Culture

We’ve all spent countless hours engrossed in movies and TV shows, but have you ever stopped to consider the financial wisdom hidden in the plot twists and character arcs? In this project, we dive into the world of pop culture to decode the financial themes that often go unnoticed.

Movies and TV shows are more than just entertainment; they’re mirrors reflecting societal values, including our attitudes toward money. By analyzing these narratives, we can gain valuable insights into financial behaviors and decisions.

Take classics like “The Pursuit of Happyness” or “Wall Street,” where the protagonists grapple with financial challenges and decisions. These stories resonate because they mirror the real-life struggles many of us face. They provide an opportunity to learn from the triumphs and mistakes of fictional characters, offering a unique perspective on financial choices.

However, it’s not just about the serious dramas. Even comedies and fantasy genres can teach us about money, sometimes in unexpected ways. From “The Simpsons” to “Breaking Bad,” financial themes often play a crucial role in shaping character motivations and plotlines.

Moreover, the media has a powerful influence on our financial behavior. Ever found yourself wanting the latest gadget after seeing it on your favorite show? That’s the media’s subtle yet effective way of nudging us towards certain spending habits. Recognizing these influences is a key step towards developing a more mindful and informed approach to personal finance.

Benefits of Financial Literacy Projects

Academic Performance:

Financial literacy isn’t just about dollars and cents; it’s about cultivating a mindset of discipline and strategic thinking. Students engaged in intro to financial literacy projects often display improved academic performance. The skills honed in budgeting, critical thinking, and problem-solving have a ripple effect, positively influencing their overall scholastic achievements. As they grasp the principles of managing money, they also enhance their cognitive abilities, setting a sturdy foundation for success in various academic pursuits.

Life Skills:

Beyond the confines of classrooms and exam halls, financial literacy projects imbue participants with life skills crucial for navigating the complexities of the adult world. From understanding the nuances of credit to mastering the art of saving, individuals emerge with a toolkit of practical skills that are immediately applicable. These projects serve as real-life simulators, preparing participants for the myriad of financial decisions they’ll encounter in their personal and professional journeys.

Future Financial Success:

Financial literacy is an investment in future financial success. Individuals equipped with the knowledge to make informed decisions about savings, investments, and debt management lay the groundwork for a stable and prosperous future. These projects serve as a compass, guiding participants toward financial independence and resilience. By instilling a sense of responsibility and prudence, financial literacy activities for adults projects pave the way for a secure and fulfilling financial trajectory.

Conclusion

In conclusion, empowering high school students financially is an investment in their future success. By providing them with practical knowledge about entrepreneurship, small business basics, and understanding taxes, we equip them with valuable life skills. These projects not only broaden their horizons but also instill a sense of financial responsibility.

As these students step into the world beyond high school, they carry with them the confidence and know-how to navigate the complexities of the financial landscape. The journey to financial empowerment begins in the classroom, setting the stage for a more secure and prosperous future.

To get your hands on more educational and free resources on coding for kids, robotics for kids, financial education for kids, etc., do check out the BrightCHAMPS Page now!

To get your hands on more such articles, educational content, and free resources on coding for kids, robotics courses, game development, etc., check out the BrightCHAMPS Blog Page now!

Frequently Asked Questions

A1. Financial literacy is the ability to understand and use various financial skills, including budgeting, investing, and managing money. It empowers individuals to make informed and responsible financial decisions.

A2. Financial literacy is crucial for high school students as it equips them with essential life skills. It prepares them for financial independence, helps them avoid debt traps, and fosters responsible money management from an early age.

A3. Teachers can integrate financial literacy by incorporating real-world scenarios into lessons. For instance, creating budgeting exercises, simulating investment decisions, and discussing the implications of financial choices in everyday life.

A4. Numerous free resources are available, such as government websites like MyMoney.gov, educational platforms like Khan Academy, and nonprofit organizations like Jump$tart Coalition, offering a wealth of tools, lesson plans, and interactive modules.

A5. Long-term benefits include improved financial stability, better credit management, and increased confidence in handling financial challenges. Financially literate students are better positioned for success in their personal and professional lives.

We are an army of educators and passionate learners from BrightChamps family, committed to providing free learning resources to kids, parents & students.

We are an army of educators and passionate learners from BrightChamps family, committed to providing free learning resources to kids, parents & students.