Welcome to the exciting world of teaching your kids the art of saving! As a parent, you know that teaching money management for kids is one of the most important life skills you can impart to them. However, teaching the concept of saving money to children can be a daunting task. Kids are naturally impulsive and often find it difficult to resist immediate gratification. But fear not! With a little creativity and a lot of patience, you can teach the concept of savings for kids in fun and engaging ways.

In this blog, we will explore four creative ways to teach your kids the art of saving. These methods are not only effective, but they are also enjoyable and will help your kids develop positive attitudes toward saving money. From fun games to digital tools, we will cover a range of strategies that will help your children understand the value of saving and develop the skills they need to manage money wisely.

Whether your kids are just starting to learn about money or are already saving their allowances, this blog is for you. You will discover practical tips and tricks that will make saving money a fun and rewarding experience for the whole family. Also, don’t forget to check out the video lesson below!

Buckle up and get ready to embark on an exciting journey to teach your kids the art of saving and help develop financial literacy for kids!

Before diving into the blog, check out this video below on 4 creative ways to teach your kids the art of saving.

Table of contents

Importance of teaching kids about saving money

Before getting started with the amazing methods that we have got for you to teach your kids about the art of saving money, let’s understand why this is an important task for you as a parent. As parents, we all want our children to grow up to be responsible and financially independent adults. Teaching your kids the importance of saving money is one of the best ways to help them achieve this goal. Not only does it help them build a solid financial foundation, but it also teaches them valuable life skills that will serve them well in the future.

By teaching your kids about saving money, you are instilling in them the value of delayed gratification. In today’s fast-paced world, where instant gratification is the norm, this is a crucial skill that will help your children make better decisions in all aspects of their lives. They will learn that sometimes it’s better to wait and save up for something they really want rather than impulsive-buying and regret it later.

Some other benefits of teaching financial literacy to kids are:

- It helps kids develop a sense of responsibility and independence.

- Saving money teaches kids about financial management and budgeting.

- Kids learn to set goals and work toward achieving them.

- It gives kids a sense of accomplishment and boosts their self-confidence.

- It is a crucial life skill that will benefit them in many ways in the future.

So now that we know how teaching your kids about money saving could be extremely beneficial for them, let’s get started with the four creative ways that we have got for you.

Set goals

As parents, we all want our kids to grow up with good habits and skills that will set them up for success. One of the best skills to teach your kids is how to save money, and there’s a creative way to do it that will make the experience fun and rewarding for everyone.

What is this creative way, you ask? It’s all about setting goals. Kids naturally love setting goals, whether it’s for school, sports, or anything else. By helping them set financial goals, you can make money management for kids a fun and exciting experience.

Start by talking to your kids about something they really want to buy or achieve. Maybe it’s a new toy, a trip, or even saving up for an extracurricular program. Once they have a clear goal in mind, you can help them break it down into smaller, more manageable steps. For example, if your child wants to save up for a new bicycle, you can help them figure out how much money they need to save each week or month to reach their goal.

Setting goals is a great way to teach kids important life skills like planning, organization, and persistence. It also gives them a sense of purpose and motivation to save money. By tracking their progress towards their goal, savings for kids will have a direct positive impact, which will further motivate them to keep going.

To make things even more exciting, you can create a savings for kids chart or a thermometer to track their progress. You can also offer rewards or incentives for reaching certain milestones along the way, like treating them to a fun outing or activity.

Teaching your kids how to save money through goal-setting is a creative and fun way to help them develop financial literacy for kids. So why not give it a try and see how much fun money management for kids can be?

Use a Clear Jar

This method is simple but effective. All you need is a clear jar or container and some coins or bills. Have your kids decorate the jar to make it their own, then start filling it up with money. As the jar fills up, they will be able to see their progress and feel a sense of accomplishment.

Using a clear jar is a great way to teach kids about the value of saving money. They will learn to appreciate the process of accumulating wealth and the power of compound interest. Watching their savings grow over time will give them a sense of pride and responsibility.

This method would be extremely effective when combined with the method of setting goal as it will drive your kids to save up in the jar with commitment.

To make it even more fun, consider adding some friendly competition. You can set up a challenge on savings for kids or make a game out of it. Maybe whoever saves the most money in a month gets to choose the family activity for the weekend!

Using a clear jar is a great way to teach your kids about saving money in a fun and engaging way. It’s a simple and effective method that will help them develop good financial habits for life. So why not try it out and see how much fun saving money can be?

Play Games

When it comes to teaching kids about saving money, there’s no need to be boring. In fact, playing games is a great way to make the experience fun and engaging for everyone involved!

There are a variety of games you can play to teach your kids about saving money. One popular game is Money Bags, which is a board game that teaches kids about counting, and saving. In the game, players take turns rolling a dice and moving their game piece around the board, collecting money, and saving it in their piggy bank.

Another fun game is the Allowance Game, which is a board game that teaches kids about managing money and making wise spending choices. In the game, players receive a weekly allowance and must make choices about how to spend their money, like buying toys or saving up for a bigger purchase.

Playing games like these can help kids learn important financial skills in a fun and engaging way. They will learn about budgeting, saving, and making smart spending choices. Plus, playing games together as a family can be a great bonding experience.

Teaching kids about saving money doesn’t have to be a chore. By incorporating games into the learning process, you can make it a fun and engaging experience for everyone involved. So why not give it a try and see how much fun saving money can be?

Use Brightchamps Money Lesson app

Are you looking for a fun and effective way to teach your kids about saving money? Look no further than the brightchamps Money Lesson app!

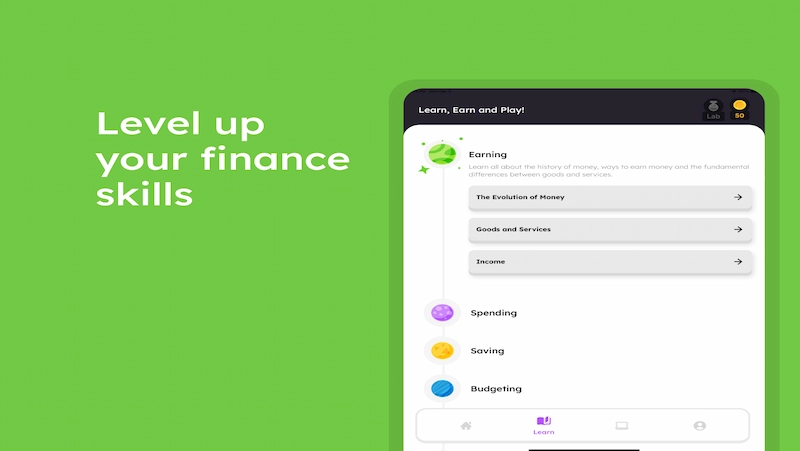

One of the standout features of the app is its “Learning with Stories” section. This feature uses relatable stories to teach kids about financial concepts like saving, budgeting, and making smart spending choices. By presenting these concepts in a fun and engaging way, kids are more likely to stay interested and retain the information.

The app also offers bite-sized lessons with real-world examples. This makes the lessons easy to understand and helps kids see how financial concepts apply to their own lives. Plus, the lessons are designed to be short and digestible, so kids won’t get overwhelmed or bored.

The app also offers global assessments and certificates. This means that kids can earn recognition for their learning and see how they stack up against other kids around the world. This can be a great motivator to continue learning and developing financial literacy for kids.

Finally, the app offers interaction with mentors. Kids can ask questions and get guidance from experienced financial professionals. This can be a great way to get personalized advice and support to develop financial literacy for kids.

Overall, the brightchamps Money Lesson app is a fantastic tool for teaching kids about saving money. So why not give it a try and see how much fun financial literacy for kids can be?

Conclusion

Savings for kids is an important life skill that can set them up for a lifetime of financial success. By using creative methods like setting goals, using a clear jar, playing games, and using the Brightchamps Money Lesson app, you can make the learning process fun and engaging for your kids. Whether you’re looking to help your child save up for a new toy, understand the importance of budgeting, or simply develop strong financial literacy skills, these methods offer effective and enjoyable ways to get there.

At Brightchamps, we are committed to helping kids develop strong financial literacy skills that will serve them well throughout their lives. Our Money Lesson app offers a range of features that make learning about money fun and effective, from learning with stories to bite-sized lessons with real-world examples, learning through play, global assessments and certificates, and interaction with mentors. By using these tools, your child can build a solid foundation for financial success and develop habits that will serve them well for years to come.

To get your hands on more educational and free resources on coding for kids, robotics for kids, financial education for kids, etc., do check out the BrightCHAMPS Page now!

So, start exploring these creative methods for teaching your kids the art of saving, and watch as they develop the skills and habits they need to achieve their financial goals. With the right tools and a little bit of fun, your child can become a confident and savvy money manager in no time.

Frequently Asked Questions (FAQs)

It’s never too early to start teaching your kids about the value of money and the importance of saving. Even preschoolers can begin to learn the basics of money management, like the concept of spending versus saving.

There are many creative ways to make learning about money fun and engaging for kids. Setting goals, using a clear jar, playing games, and using interactive apps like the Brightchamps Money Lesson app are all effective ways to teach financial literacy while making it enjoyable for your child.

The Brightchamps Money Lesson app is an interactive learning tool designed to help kids develop strong financial literacy skills. With features like learning with stories, bite-sized lessons with real-world examples, learning through play, global assessments and certificates, and interaction with mentors, the app offers a fun and effective way for kids to learn about money management.

We are an army of educators and passionate learners from BrightChamps family, committed to providing free learning resources to kids, parents & students.

We are an army of educators and passionate learners from BrightChamps family, committed to providing free learning resources to kids, parents & students.