In today’s complex world, it’s really important to understand and handle money well. Financial know-how, which is often missing in regular school, is a basic skill we all need. Being able to make smart money choices, budget right, save, and invest can make our lives much better.

Also, learning about money helps students deal with money challenges and chances they’ll face as they grow up. Whether it’s saving for college, buying a house, or getting ready for retirement, having a good grasp of money basics is crucial for staying financially secure.

The best way to learn is through hands-on experience. Lectures and textbooks provide essential theoretical knowledge, but practical application is where students truly grasp the intricacies of personal finance. By using a project-based approach, we can foster a deeper understanding of financial concepts and ensure that students are better prepared for the financial challenges that await them in adulthood.

Table of contents

- Project 1: Money Management Board Game

- Project 2: Student-Run Mini Business

- Project 3: Stock Market Simulation

- Project 4: Personal Finance Blogs

- Project 5: Budgeting for Real-Life Scenarios

- Project 6: Investment Portfolio Challenge

- Project 7: Financial Literacy Fair

- Conclusion

- Frequently Asked Questions (FAQ’S)

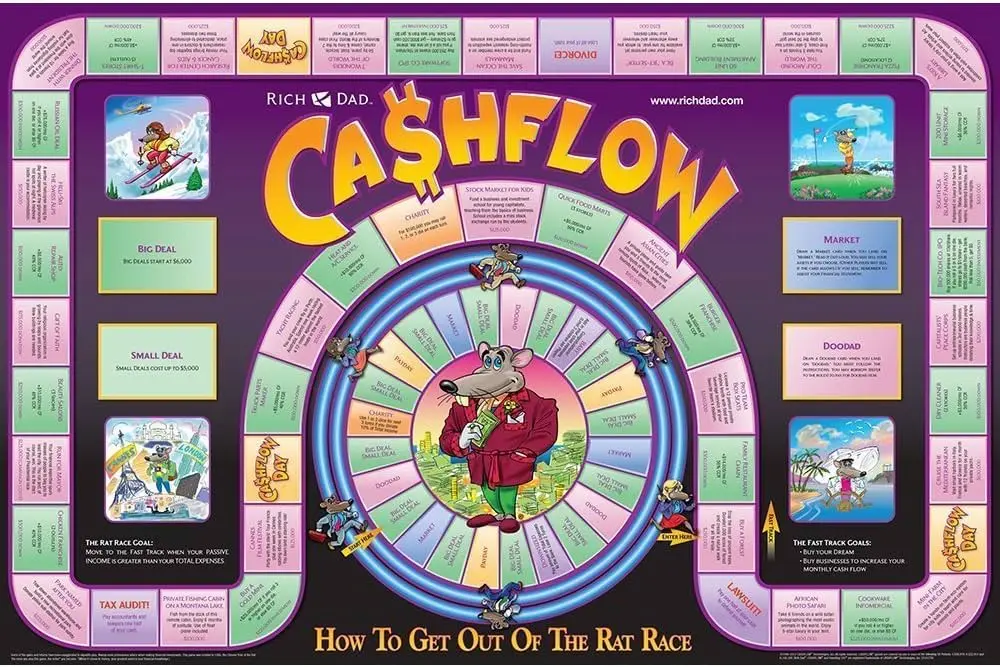

Project 1: Money Management Board Game

1. Game Concept and Rules

In this type of game, they navigate a world of financial decisions and challenges. They must manage budgets, make strategic choices, and even invest. This interactive and engaging game educates and entertains them.

Students gain a practical understanding of money management through this game play. They learn how to budget, save, and invest, all while having fun with their peers. This project provides a dynamic and enjoyable way to develop essential financial decision-making skills.

One of the most valuable lessons from this project is the understanding of how financial decisions can have long-term consequences. Students realize that the choices they make in the game can affect their financial well-being down the road. This insight encourages them to think critically and make more informed financial decisions.

2. Crafting the Game Board

The creative aspect of this project is equally important. Encouraging students to design the game board, cards, and rules empowers them to think outside the box and collaborate effectively. These skills are not only vital for creating the game but also for success in real-world situations.

Project 2: Student-Run Mini Business

1. Starting a Small Business in School

Doing it practically is the best study tip for students to understand something thoroughly. Starting a small business in school, like selling snacks, crafts, or tutoring, is a great way to teach students about handling money responsibly. This hands-on experience shows them how to manage their finances by budgeting, using resources wisely, and planning for the future. These skills also help them in their personal money management.

2. Budgeting and Profits

Foundation of money management is budgeting. So, they can start with budgeting for kids or students. Within this project, students are tasked with creating budgets for their mini-business. They need to allocate resources wisely to maximize profits. This practical experience helps them understand the importance of financial planning and how it impacts the bottom line.

Marketing and salesmanship are fundamental aspects of any business. This project not only educates students about these principles but also provides them with firsthand experience in attracting customers, promoting their products or services, and closing deals. These skills are invaluable in both personal and professional life.

Project 3: Stock Market Simulation

1. Introduction to Stock Markets

Many people have no idea what stocks are, but it’s crucial to know how it operates for a good grasp of money matters. A stock market game lets students try out investing without any real money at stake. This helps them learn about stocks, bonds, and investments. With this information, they can make smart choices about their money and investments in the future.

2. Simulated Stock Trading

In the simulation, students use virtual money to buy and sell stocks. They experience the fluctuations and dynamics of the market, enabling them to grasp the complexities of investment. This practical experience builds their confidence and knowledge in a controlled environment.

3. Analyzing Investment Strategies

The stock market simulation not only introduces students to the world of investing but also allows them to experiment with various investment strategies. They can learn the importance of research, risk assessment, and portfolio diversification, which are all crucial skills for any investor.

Project 4: Personal Finance Blogs

1. Setting Up Student Blogs

Blogging provides a fantastic platform for promoting financial literacy while enhancing students’ writing and communication skills. Encouraging students to create personal finance blogs where they do knowledge sharing means their financial knowledge and experiences are shared by them.

Setting up and managing a blog is a learning experience in itself. It teaches students valuable digital literacy skills, such as website creation, content organization, and effective use of online resources.

2. Writing About Financial Topics

Writing about financial topics helps to encourage students to research and understand various aspects of personal finance. They delve into subjects like budgeting, saving, investing, and financial planning. This process not only deepens their understanding but also improves their ability to articulate complex financial concepts.

3. Sharing Knowledge with Peers

By sharing their blogs with peers, students engage in meaningful discussions about money management. They can learn from each other’s experiences and insights, creating a supportive community of young financial enthusiasts who collectively build their financial literacy. This peer-to-peer learning dynamic is invaluable.

Project 5: Budgeting for Real-Life Scenarios

1. Simulating Realistic Financial Situations

This project helps students get ready for practical money situations by making up real-life money problems. These problems could be about getting an apartment, purchasing a car, or saving for college. By working on these problems, students figure out how to use their money skills in real life. They learn about handling money in different situations and see why planning your finances is important in everyday life.

2. Creating Student Budgets

Students are tasked with creating budgets tailored to the specific scenarios they face. This exercise requires them to consider income, expenses, and savings goals. It reinforces the practical application of budgeting principles.

Life is full of unexpected expenses, and this project helps students anticipate and manage these financial curveballs. By incorporating unforeseen costs into their budgets, students learn to adapt and make informed decisions when financial challenges arise.

Project 6: Investment Portfolio Challenge

1. Virtual Investment Portfolios

In addition to understanding the stock market, students can create virtual investment portfolios using real stock market data. These portfolios allow students to experiment with different investment strategies without any real financial risk.

By tracking these portfolios over time, students gain insight into the dynamics of investments, how to manage risk, and the rewards of making informed investment decisions.

2. Tracking Stocks and Mutual Funds

This project deepens students’ understanding of investments as they track individual stocks, mutual funds, or other financial instruments within their portfolios. The experience teaches them the importance of monitoring investments and staying informed about market trends.

When students review their investment portfolios and compare how well they’re doing compared to standard measures, they learn important things about the risks and rewards involved. This helps them make smart choices when handling their own money investments.

Project 7: Financial Literacy Fair

The financial literacy for students fair is a culmination of these projects, providing an opportunity for students to showcase their newfound knowledge to the entire school community. Theese fairs can be exciting events that draws attention to the importance of financial literacy.

Not only does the fair serve as a showcase for students’ achievements, but it also promotes awareness of financial literacy among the entire school community, including parents, teachers, and peers. It emphasizes the practical benefits of financial education.

1. Student Booths and Exhibits

Students can set up booths in a fair, and they can exhibits to demonstrate their projects. From showcasing their money management games to detailing their experiences in running mini-businesses, these exhibits allow students to share their learning with others.

This interactive aspect of the fair encourages engagement and conversations. Students become educators, explaining their projects and sharing their knowledge with visitors, reinforcing their own understanding in the process.

It provides a unique opportunity for the entire school community to participate in interactive learning. Students, parents, teachers, and peers can all benefit from the wide variety of projects on display. This event highlights the significance of teaching financial literacy early on, emphasizing how a financial literacy course for kids can positively impact their understanding of money management and prepare them for real-world financial decisions.

Conclusion

Learning about money is a skill for life that all students should learn. These projects help students understand how to manage their money confidently. This sets them on a path to a better, more secure future. When we teach students about money in a practical and interesting way, we give them the knowledge and skills to make smart money choices and be financially healthy. So, let’s not wait—start using these projects and see your students become smart with money.

To get your hands on more educational and free resources on coding for kids, robotics for kids, financial education for kids, etc., do check out the BrightCHAMPS Page now!

To get your hands on more such educational and free resources on coding, robotics, game development, etc., do check out the Brightchamps Blog Page now!

Frequently Asked Questions (FAQ’S)

A1: Instilling financial responsibility in children begins with leading by example. Show them how you manage money, save, and make wise spending choices. Create a clear allowance system, set up savings accounts, and involve them in age-appropriate discussions about family finances. Encourage them to save a portion of their allowance or earnings and explain the concepts of needs vs. wants.

A2: Yes, there are several fun and educational games and activities that can teach kids about money. Board games like Monopoly and The Game of Life provide hands-on experience with budgeting and decision-making. Online games and apps like “PiggyBot” and “Money Metropolis” can also make learning about finances engaging and interactive.

A3: Make budgeting relatable and fun. Use real-life examples, like planning a family outing or saving for a special toy. Involve your children in setting a budget for these activities, allowing them to make choices and see the results. This approach makes budgeting less of a chore and more of a practical life skill.

A4: Yes, you can introduce saving to young children by giving them clear piggy banks or savings jars. Encourage them to save a portion of their allowance or any money they receive as gifts. Explain that saving money allows them to buy something special in the future. As they get older, open a bank savings account in their name to further reinforce the concept of saving.

A5: Setting financial goals is crucial in teaching children about planning and discipline. Help them set achievable short-term goals, such as saving for a favorite toy, and long-term goals like saving for college or a future car. These goals provide motivation and a sense of accomplishment, fostering a lifelong habit of goal-setting and financial planning.

We are an army of educators and passionate learners from BrightChamps family, committed to providing free learning resources to kids, parents & students.

We are an army of educators and passionate learners from BrightChamps family, committed to providing free learning resources to kids, parents & students.