Money is an essential part of life, and introducing financial concepts early can help lay the groundwork for a strong financial future. Enrolling preschoolers in finance classes for kids allows them to start building important skills like budgeting, saving, and making informed decisions, setting them up for success in managing money as they grow.

Preschoolers learn best through play. Money activities that are engaging, fun, and interactive can effectively impart financial knowledge while keeping little ones entertained. In this blog, we’ll explore ten creative money activities that will help your preschooler become financially savvy.

Table of contents

Here are the 10 best financial games for kids:

1. Coin Counting Adventure

Materials Needed:

- A jar of assorted coins

- A piece of paper and a pen

Step-by-Step Instructions:

- Spread the coins on a table.

- Encourage your child to group them by type (e.g., quarters, dimes, nickels, and pennies).

- Help them count each group and record the totals on the paper.

- Discuss the total value and what they could buy with it.

Explanation: This activity teaches kids the basics of coin recognition, sorting, counting, and understanding the value of different coins. It also introduces them to the concept of saving money like starting a piggy bank for kids for future needs.

2. Building a Savings Jar

Materials Needed:

- An empty jar

- Decorative materials (stickers, paint, markers)

- Play money or real coins (optional)

Step-by-Step Instructions:

- Have your child decorate the jar.

- Explain that the jar is for saving money.

- Encourage them to add coins they receive as gifts or find around the house.

- Discuss what they’re saving for, whether it’s a toy or a treat.

Explanation: Building a savings jar helps kids understand the importance of saving and goal setting. It also allows them to visualize their progress as they watch their savings grow.

3. Money Math with Play Dough

Materials Needed:

- Play dough in different colors

- Play money (optional)

Step-by-Step Instructions:

- Create play dough “coins” of various denominations.

- Ask your child to make purchases with their play money, using the play dough coins.

- Practice addition and subtraction by “buying” and “selling” play dough items.

- Reinforce math skills while exploring financial concepts.

Explanation: This hands-on activity combines math and money, helping children learn to count, add, and subtract while using play money for realistic transactions.

4. Shopping in a Mini Mart

Setting Up a Mini Mart:

- Gather play food items and price tags.

- Arrange them on a table or shelf.

Shopping Role-Play:

- Assign roles – one as the shopkeeper and the other as the customer.

- Use play money to buy items from the mini mart.

- Encourage negotiation and decision-making during play.

Explanation: Role-playing shopping at a mini mart teach budgeting for kids, making choices, and understanding the value of money in a fun and interactive way.

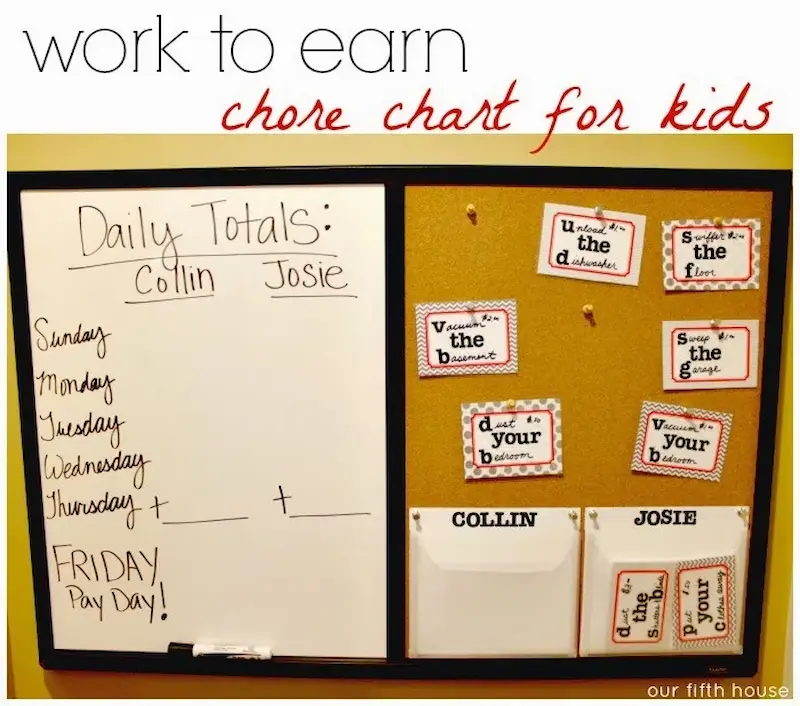

5. Chore Chart and Earnings

Creating a Chore Chart:

- Design a simple chore chart.

- Assign age-appropriate tasks.

Earning Play Money:

- Reward your child with play money for completing chores.

- Discuss the concept of earning and saving.

- Encourage them to set goals for their earnings.

Explanation: This activity teaches responsibility and the connection between work, earning money, and setting financial goals.

6. Fun with Piggy Banks

Decorating Piggy Banks:

- Provide plain piggy banks and art supplies.

- Let your child personalize their piggy bank.

Dropping in Coins:

- Whenever your child earns or receives coins, encourage them to drop them into their piggy bank.

- Discuss the importance of saving for the future.

The Joy of Saving:

- Share stories of your own experiences with saving and the excitement of reaching financial goals.

Explanation: Piggy banks are a classic tool for teaching kids about saving, and personalizing them makes the process even more enjoyable. Sharing personal stories emphasizes the rewards of saving.

7. Money-Themed Storytime

Selecting Money Storybooks:

- Choose age-appropriate books with money-related themes.

Storytelling Session:

- Read the selected story to your child.

- Discuss the financial concepts presented in the book.

- Ask questions to gauge their understanding.

Explanation: Reading money-themed storybooks can make financial concepts relatable and engaging to teach kids about money for children, sparking discussions and enhancing their understanding.

8. Money Board Games

Recommended Board Games:

- Look for games like “The Game of Life” or “Monopoly Junior.”

Family Game Night:

- Plan a family game night with money-themed board games.

- Encourage discussions about strategy, budgeting, and decision-making.

Explanation: Money board games are an enjoyable way for the whole family to learn about finances, strategy, and planning.

9. DIY Lemonade Stand

Setting Up the Stand:

- Help your child create a simple lemonade stand.

- Provide ingredients and supplies.

Selling Lemonade:

- Teach your child about pricing and making change.

- Encourage them to interact with customers and count their earnings.

Explanation: Running a lemonade stand introduces kids to entrepreneurship, pricing, customer service, and handling money in a real-world context.

10. Visiting a Real Bank

Planning a Bank Visit:

- Contact your local bank to arrange a visit.

- Ask for a tour and basic banking explanations.

Understanding Banking Basics:

- Show your child how a bank operates.

- Discuss the purpose of banks, savings accounts, and safety deposit boxes.

Explanation: A visit to a real bank provides children with a tangible experience of how banking works, fostering financial literacy and understanding the role of banks in the economy.

Conclusion

Empowering preschoolers with financial knowledge is a gift that will benefit them throughout their lives. These ten money activities are not only educational but also enjoyable for both parents and children.

By introducing your child to money concepts in a playful and informative way, you’re setting them on the path to a brighter financial future. Start early, have fun, and watch your preschooler grow into a financially responsible individual. Happy learning!

To get your hands on more educational and free resources on coding for kids, robotics for kids, financial education for kids, etc., do check out the BrightCHAMPS Page now!

To get your hands on more such educational and free resources on coding, robotics, game development, etc., do check out the Brightchamps Blog Page now!

Frequently Asked Questions (FAQ’S)

A1. There are several fun and educational money activities for preschoolers:

Coin Sorting: Provide a variety of coins and help them sort them by size, color, or denomination. This activity helps with basic recognition of coins.

Play Store: Set up a pretend store at home using toys or household items. Use play money, or create your own, to teach them about buying and selling.

Counting Coins: Practice counting coins together. Start with simple amounts, and as they become more comfortable, introduce larger values.

Piggy Bank Fun: Have them decorate their own piggy bank and encourage them to save spare change.

Money Stories: Read children’s books that involve money-related themes to make learning more engaging.

A2. Teaching money concepts to preschoolers is crucial for several reasons:

Early Financial Literacy: Money is an integral part of everyday life, and introducing these concepts early helps build a strong foundation for financial literacy.

Practical Life Skills: Learning about money helps children understand how to manage their finances, make informed choices, and budget.

Decision-Making: It encourages critical thinking and decision-making skills as they learn the value of saving, spending, and sharing.

Responsible Money Habits: Early exposure to money concepts instills responsible money habits and reduces the likelihood of financial difficulties in adulthood.

A3. To make money lessons engaging for preschoolers:

Use hands-on activities and games that involve counting, sorting, and role-playing.

Incorporate storytelling and books with money-related themes to capture their interest.

Relate money concepts to everyday experiences, like shopping or saving for a special toy.

Keep lessons short and age-appropriate to maintain their attention.

Be patient and create a positive learning environment.

A4. For preschoolers, age-appropriate money activities include:

Identifying and sorting coins by attributes like size, color, and value.

Playing pretend store or restaurant games using play money.

Counting small amounts of money and understanding basic values.

Decorating a piggy bank and discussing the idea of saving.

Reading simple children’s books with money themes.

A5. Yes, there are online resources and apps designed to teach money skills to preschoolers:

PiggyBot: An app that helps kids track their allowances and set savings goals.

Counting Coins: Online games and activities that teach coin recognition and counting.

Financial Literacy Apps: Several apps, like “Bankaroo” and “iAllowance,” are designed specifically for kids to learn about money in an interactive way.

Educational Websites: Websites like MoneyAsYouGrow.org offer resources and activities for teaching financial concepts to children.

We are an army of educators and passionate learners from BrightChamps family, committed to providing free learning resources to kids, parents & students.

We are an army of educators and passionate learners from BrightChamps family, committed to providing free learning resources to kids, parents & students.